When it comes to mastering your money, both personally and in business – an important piece to success is the (dreaded) credit score and credit report. It’s often referred to as the FICO score.

When it comes to mastering your money, both personally and in business – an important piece to success is the (dreaded) credit score and credit report. It’s often referred to as the FICO score.

The 3 bureaus that provide all your credit information are Experian, Trans Union, and Equifax.

The reports and scores are important to have in your possession. But, you should also to keep track of changes – over time.

Things do change, and sometimes without you knowing it. Therefore, you should stay on top of it, and know your options.

To get a free report – follow these easy steps. And, you should go do it right now. Your privacy is protected, and this applies to the United States specifically.

And, after you’ve done and printed out the below, consider calling your credit card companies and ask to lower your interest rate. In fact, a good score and good payment history will in most cases allow you to do this. See – the credit reporting and scoring discovery is already helping you.

An updated credit report along with your credit score is what you need. Keep in mind, there is a scoring system for your personal affairs, as well as for your organization.

Steps to obtain reports for FREE:

1. Go to annualcreditreport.com.

2. Select each of the agencies (Experian, TransUnion and Equifax) – go through the steps one at a time.

3. Make sure you don’t log out or close your browser. These reports are provided for you in one session.

You are only allowed to get these reports once per 12 months, so make sure you fill out the forms carefully. Then, once your reports are available, print them to a PDF, or hard copy (printer). Some of them will provide a score, others will have a small charge for it. Get them all.

If you need a PDF writer to save the documents to, go here: https://www.cutepdf.com/products/cutepdf/writer.asp — it’s free. Install this product first, and select the CutePDF Writer in you printer box selection.

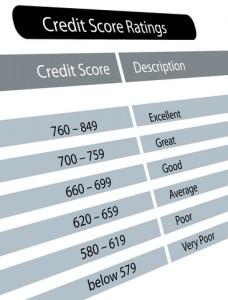

Finally – what is a good credit score?

P.S.

You should protect your identity and make sure your credit monitoring is in place. Lifelock can be a good option.

P.P.S.

Did you know you might have money waiting for you? Try Missing Money – the credit reports will not tell you about that:

And, when you work with a money management or investment firm, make sure you don’t hire these guys:

Straight Talk – Stock Market by senatork

Related articles to free credit reporting scoring

- Understanding The Difference Between A Hard And Soft Credit Report Pull (creditscore.net)

- Don’t Swear Off Credit Cards After Credit Repair (creditrepair.org)

- How to Pick a Secured Credit Card for Credit Repair (creditrepair.org)